How Spotify Reshaped the Traditional Music Industry

The music industry has undergone a seismic shift over the past two decades, with Spotify often blamed for “killing” the traditional model. While some argue this is simply progress, mirroring the decline of physical media in other industries like Blockbuster for movies or GameStop for games, the reality is more nuanced. Spotify didn’t single-handedly destroy the music industry, but it fundamentally altered its structure, shifting revenue streams, empowering some artists while marginalizing others, and paving the way for new technologies like AI to further disrupt the landscape.

The Fall of Physical Media and the Rise of Streaming

The transition from physical media to digital isn’t unique to music. Just as Blockbuster failed to adapt to streaming movies and GameStop now relies on merchandise to survive, the music industry faced similar challenges. In the late 1990s, CDs dominated, but they were expensive, costing labels about 12 cents to press and selling for $15, with artists often receiving just a 3% share. This model was far from ideal, as major labels held a monopoly, controlling distribution and promotion, often leaving artists financially strained or creatively stifled. Thousands of musicians were exploited, neglected, or abandoned by labels before ever gaining recognition.

Spotify, launched in 2008, capitalized on a trend that began with Napster in 1999, which introduced peer-to-peer file sharing and rampant piracy. Contrary to the idea that “everyone” was pirating music by the late 1990s, internet access was limited. In 1999, only about 35% of U.S. households had internet access, and speeds (28.8k to 56.6k dial-up) made downloading a single track an hour-long ordeal. CD burners, costing thousands, were also rare until the early 2000s. Piracy via cassette tapes, often using double cassette decks, was more common in the 1980s and 1990s, but quality degraded with each copy, necessitating an original “master” album purchase. This limited the scale of piracy compared to digital downloads later on.

Apple, not Spotify, initially transformed the landscape. The iPod (2001) and iTunes (2003) made MP3s mainstream, shifting music from a niche format to a commercial product. By 2007, the iPhone further integrated music into daily life. While early MP3 players like the Sony Discman existed in the 1990s, they lacked the storage and accessibility of Apple’s ecosystem. Apple’s influence trained a generation to expect digital music, but Spotify took it further by introducing streaming in 2008. By 2022, streaming accounted for 65% of global music revenue, with Spotify boasting over 600 million users by 2025, including 220 million premium subscribers.

Spotify’s Role: A Double-Edged Sword

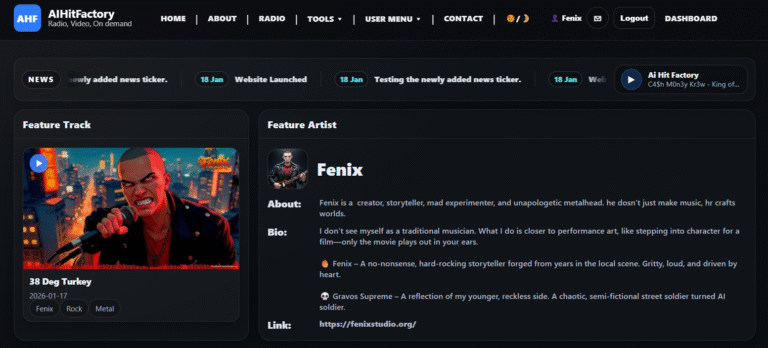

Spotify didn’t invent streaming, but it perfected it, adopting a Netflix-like model before Netflix could pivot to music. It democratized access, allowing independent artists to upload music and reach global audiences without label backing. Tools like Spotify for Artists provide analytics, helping musicians track performance and engage fans directly. In 2024, over 50% of artists earning at least $1,000 in royalties on Spotify made most of their income from outside their home country, showcasing the platform’s global reach.

However, Spotify also shifted revenue streams, often to the detriment of artists. The traditional model relied on album sales, touring, and merch, revenue streams artists still depend on today. Spotify’s per-stream payout, averaging $0.003 to $0.005, is notoriously low, and payments go to rights holders (often labels), not directly to artists. In 2023, independent artists earned about $4.5 billion on Spotify, but this is only 30% of total payouts, with major labels still dominating. Features like Discovery Mode, where artists trade lower royalty rates for more streams, further reduce earnings. This has led to criticism, with campaigns like #JusticeAtSpotify advocating for fairer rates.

Spotify doesn’t help artists get discovered, as users primarily go there to hear familiar hits from major stars like Ariana Grande. Spotify’s algorithm-driven playlists, like Discover Weekly, do introduce new music, but major label artists dominate streams. In 2018, the top 10% of artists accounted for 99% of streams, a trend that continues. Independent artists often gain fans through social media, live performances, or platforms like YouTube, not Spotify. However, Spotify remains essential for visibility, regular listeners aren’t flocking to SoundCloud or Bandcamp to discover indie bands.

The Persistent Power of Labels

Labels haven’t lost power; they’ve adapted. Major labels now control much of Spotify’s content indirectly, as they can pull their catalogs, think Taylor Swift or Radiohead, who temporarily removed their music over royalty disputes but later returned. In 2024, the three major labels earned $12.5 billion from streaming alone, with Spotify contributing a third of that. Labels have shifted focus to streaming revenue (83% of U.S. recorded music revenue in 2021), negotiating licensing deals with platforms like Spotify to maintain their dominance.

The AI Threat and the Future

The rise of AI in music adds another layer of complexity. Artists like Lupe Fiasco and Sting are using AI for radio stations, DJs, and song completion, yet many decry AI-generated music as theft, arguing it “learns” from existing work. Meanwhile, distributors are rejecting AI music while reportedly creating their own to cut out artists, a hypocritical move echoing the finger-pointing you mentioned. Spotify and Apple Music are also training AI models on artists’ music, often with permission buried in terms of service. This could further monopolize the industry, as Spotify’s platform gives it a unique position to dominate AI-generated music distribution.

Your view on AI as a tool, not a threat, aligns with its potential. AI can help artists create beats, promo clips, or social media posts, leveling the playing field. However, the line between “real” and AI music is blurring, live performances now use autotune, yet AI-generated tracks face bans from distributors. Listeners ultimately decide what they enjoy, often prioritizing quality over authenticity, much like nostalgia for 1980s movies doesn’t make them “better” than modern films.

A Strategy for Artists

Spotify hasn’t killed the industry, it’s intercepted revenue that once went to labels, redistributing it unevenly. The album may be dead, as you noted, but it’s been declining since iTunes atomized music into singles. Streaming is good for artists if used strategically. Treat Spotify like the radio of old, release singles on Spotify, Apple Music, TikTok, and YouTube to gain visibility, but keep your full discography on platforms like Bandcamp, where fans can pay for deeper cuts (e.g., 50 cents per track). Consistent engagement ,teasers, behind-the-scenes content, and AI-assisted promos, can build a following. Experienced musicians have an edge in mixing and recording, using AI as a base to craft polished tracks.

Conclusion

Spotify didn’t kill the traditional music industry, it accelerated its transformation, for better and worse. It broke the label monopoly on distribution but introduced new challenges with low payouts and algorithmic bias. Apple laid the groundwork, but Spotify redefined the game, and now AI threatens to reshape it again. Artists must play smart: use streaming for exposure, AI for creation, and alternative platforms for revenue. The industry isn’t dead, it’s evolving, and those who adapt will thrive.